Through award winning programs, Talent and Development is designed to provide foundational knowledge and skills in compliance, AR technology and effective call handling skills. Discover the essential components of any cleaning service invoice along with best practices on how to bill for cleaning services in general. We’re here to help simplify things for you with this guide on how to create an accounting system for a small business.

The Different Types of Accounts Receivable Management Services

Our software syncs effortlessly with your accounting software – be it Quickbooks, Clio, or Xero. From there, you’re able to completely automate the AR process with the initial invoice sending, late payment reminders, auto-collecting, and more. Provide various communication channels for customers to connect with your team. Establish a system for sending payment reminders and collection requests. Tasks such as responding to customer queries, addressing unpaid invoices, and aligning financial statements with outstanding invoices demand significant time.

Centralize cash flow with a single bank account that supports both payments and receipts. Reduce your cost and improve liquidity management with this flexible solution. Our solutions give our clients a competitive advantage by providing improved cash flow, lower operating costs, reduced bad debt expense and improved customer retention. Receivia services include extended business office, third-party insurance billing and collections, patient access management, medical records coding, and information technology solutions. Satisfied customers are more likely to pay on time and maintain a positive business relationship. Clear communication and efficient payment processes contribute to higher customer satisfaction levels.

AR management services are specialized services aimed at journal entry definition optimizing the process of collecting these outstanding invoices. This entails more than just chasing down late payments and keeping track of how much a company is owed at any given time. Most businesses operate on credit, but when you sell goods on credit, there’s always a risk that some customers may miss the due date, fail to pay the invoice and affect your cash flow. One of the primary goals of accounts receivable management is to ensure the timely collection of outstanding invoices.

Bank of America Intelligent Receivables®

A smooth transition and the ability to mold services to fit your specific needs can be a game-changer. Both options have their advantages and disadvantages, and the best choice depends on the specific needs and resources of the business. Outsourcing, on the other hand, frees up resources, provides specialized expertise, efficiency, and scalability, but it can lead to a loss of control, potentially higher costs, and communication challenges. To make the best decision, companies should carefully assess their needs, resources, and objectives. Find the perfect CRM solution tailored to streamline your real estate wholesaling …

Credit management software

- Internal management offers control over processes, familiarity, and potential cost savings, but it can be time-consuming, requires expertise, and may strain limited resources.

- Compliance and Information Security is embedded in our culture, in our DNA, and we have a track record of maintaining the industry’s highest standards of both.

- Knowing what you need will help streamline your search and ensure the service aligns with your business goals.

Ideally, you’d find a service provider through a recommendation/referral from someone you trust. For more information on how Chaser can help your business with both automated internal receivables management or expert outsourced receivables management, book a call with an expert today. Consulting with a financial advisor or exploring cutting edge software solutions like Chaser that can support in-house receivables management can be helpful in making an informed decision. Additionally, payment terms should be consistent across all invoices and contracts to ensure clarity and consistency for customers. Businesses have the choice to expected return and variance for a two asset portfolio manage receivables internally or outsource to third-party providers. Internal management offers control over processes, familiarity, and potential cost savings, but it can be time-consuming, requires expertise, and may strain limited resources.

Converting or Implementation can be a blocker, luckily we have migration-specific automation tools at low costs. Maintaining clear and well-documented billing procedures enhances efficiency and consistency within your business operations. With offshore, nearshore, domestic sites and Work at Home solutions, we have multiple global options ready to deliver results, along with the ability to scale and grow rapidly.

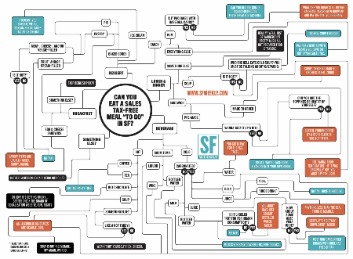

Use cloud-based software to access your AR system from anywhere, anytime. An example of AR management could be a company implementing a credit policy that includes extensive credit checks on potential clients. This organization may also employ an automated system to send invoices and payment reminders, as well as a periodic analysis of its accounts receivable aging report to identify and address late payments.

That being said, we’re here to help you alleviate all this by guiding you through the process of finding a partner for the management of accounts receivable. Managing cash flow is crucial for any business, regardless of size or industry. ConServe’s innovative collection solutions have helped income tax expense Clients maximize recoveries and reduce defaulted accounts. “Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation.

However, it’s also important to note that some companies are wary of outsourcing their accounts receivable management services. This is because debt collection services can be belligerent, and if you’re outsourcing your debt collection function, there’s always a chance that the vendor you work with will harm your brand’s reputation. Many companies prefer to keep the receivable management process in-house to retain full control of their interactions with clients. Ultimately, whether you choose to outsource to a third party is up to you, but the importance of receivable management services is undeniable.